SC

Slicer

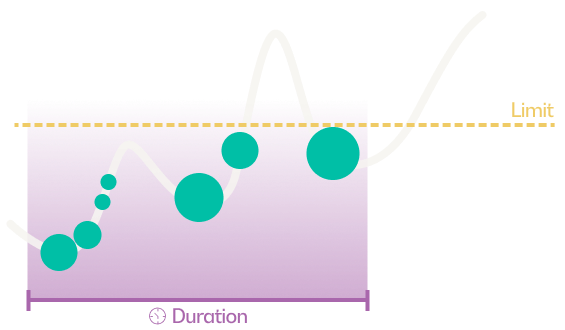

A slicer is a short-duration TWAP strategy.

The strategy will spread the executions of the order up to 15 min from the start.

25%-50%

Parameters

- Always Passive

- Duration

- Happy Level

- Price Limit

- Trigger Price

Always Passive

If this parameter is checked, the exchange always passive flag is enabled.

If the exchange rejects an order because the price will cross the spread, the Smart Order will immediately resend a new order with an updated price.

Contact us

Founded and based in Norway by experienced professionals with background in trading and financial technology.

Contact us!