BULL Trader

BULL Trader

Auto trader

This is a fully automated strategy for sideways and bull markets. It buys on dips and takes profit on rebounds.

A high frequency of small trades provides consistent daily returns with lower risk.

An optional high watermark (trailing) stop loss protects against unexpected trend shifts.

Parameters

- Risk

- Max Position

- Stop Loss

- Tempo

Risk

Normal Mode: The strategy will open new positions moderately, giving you more room for error if the market moves in an unfavourable direction.

Bonkers Mode: When you want to go a bit nuts! The strategy will open positions much quicker and be less price-restrictive. Bonkers mode will result in higher profit but is much riskier and requires more manual monitoring than normal mode.

Why use the BULL trader?

I am looking for stable earnings, not a lottery ticket.

I want a strategy that trades automatically so I can do other stuff.

I am a PRO trader, but I like to trade more products with less effort and diversify my risk.

I lack trading experience but want to trade like a pro, not just buy and hold.

I want to trade 24/7 and take advantage of more opportunities to make a profit.

Please look at when to use this strategy before running it!

When to use the BULL trader?

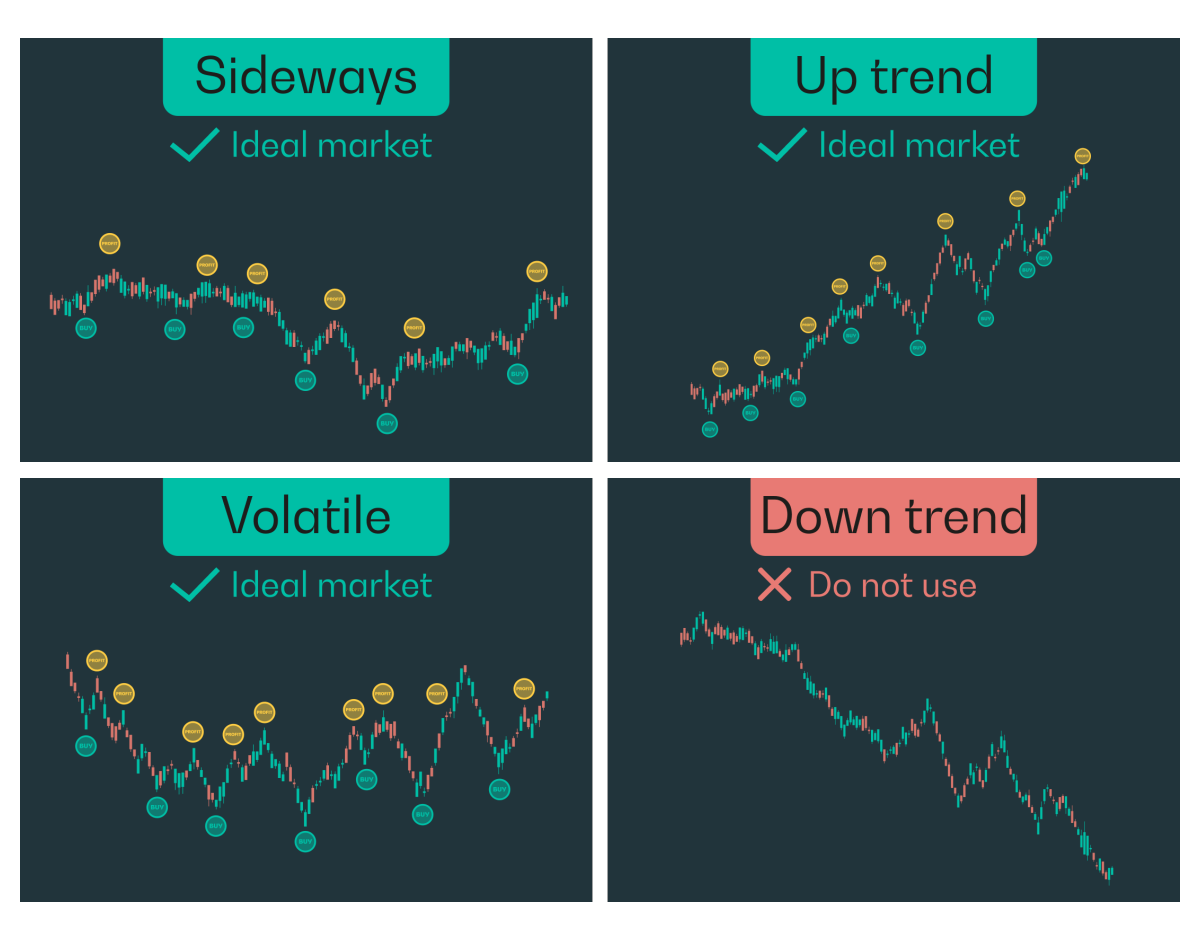

It works in most market conditions, but it’s purposely built for:

Bull markets

Sideways markets

Volatile markets

I am uncertain when to buy and when to lock in profit.

I can’t predict future price moves but I am confident that the market won’t go down hard.

It will only buy when there is a short-term uptrend and pause buying if the market moves down. This gives you room for error but will not protect against the market taking the elevator down to the basement.

How to use the BULL trader?

Max Position

The maximum exposure the strategy can open.

Stop Loss

The stop loss: Highwater mark – (highwater mark * stop loss percentage).

The invested amount: (MAX position size * the market price).

The high watermark: The highest profit peak plus the invested amount.

Tempo

Low: The strategy will open new positions slowly, at approximately 20% of the maximum position per hour.

Medium: The strategy will open approximately 30% of the max position per hour.

High: The strategy will open approximately 40% of the max position per hour.

Risk

Normal Mode: The strategy will open new positions moderately, giving you more room for error if the market moves in an unfavourable direction.

Bonkers Mode: When you want to go a bit nuts! The strategy will open positions much quicker and be less price-restrictive. Bonkers mode will result in higher profit but is much riskier and requires more manual monitoring than normal mode.

How can I get the BULL trader?

Open an account today and get access to BULL Trader algorithm.

Download our Desktop Terminal and our iOS app

Book a demo to learn how to use the system

Contact Sales

Contact us

Founded and based in Norway by experienced professionals with background in trading and financial technology.

Contact us!